MOST RECOMMENDED BOOK FOR SERIOUS TRADER - RICHARD DENNIS TURTLE'S

Friday, December 30, 2011Posted by BETRAS SWING SYSTEM at 4:25 AM 0 comments

THE MOST SUCCESFUL RICHARD DENNIS TURTLES WEBSITE

Tuesday, December 27, 2011The most successful turtle was apparently Curtis M. Faith. Trading records show that Mr. Faith, who was only 19 when he started the program, made $31.5 million in profit for Mr, Dennis.

Check his website :

www.tradingblox.com

Posted by BETRAS SWING SYSTEM at 4:45 PM 0 comments

DIVERSIFY YOUR TRADING TO PASSIVE INCOME

Monday, December 26, 2011As salam, get 50% bonus, register as an affiliates or IB before you open account, recommend to your friends for extra and passive income, Those who like to trade EURUSD is good for you with 2pips spread, wasalam. Happy trading. Local Depo and withdrawal in Malaysia. Wasalam

http://www.tradefort.my/

Posted by BETRAS SWING SYSTEM at 4:08 PM 0 comments

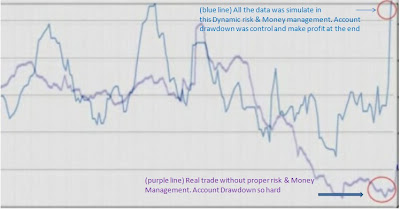

Dynamic Risk & money Management (last simulation)

Tuesday, December 20, 2011Posted by BETRAS SWING SYSTEM at 8:58 AM 0 comments

WHY MOST PROFESIONAL TRADERS RECOMMEND NOT USE MORE THEN 2% RISK PERTRADE.

Sunday, December 11, 2011As salam satu data menarik yg saya dapati dari richard Dennis trading system yg dipanggil "Donchian Trend system" - ia hanyalah trend breakout dan moving average sahaja, dari analisa statistic yg dibuat olehnya Max Drawdown (penyusutan keuntungan dan equity) Versus Risk Per Trade (%) Varies...sy rasa system skrg adalah jauh lebih baik kerana systemnya dgn > 3.5% risk per trade Max drawdown adalah 100%.maknanya total loss atau dgn bahasa yg lebih lembut MARGIN CALL. 2% risk per trade max drawdown 70% dan 1% risk pertrade max drawdown 30%. Even BETRAS SWING system pada bulan July dan Aug pada tahun sesiapa yg menggunakan >5% risk tanpa reduce risk atau stop trading akan menghadapi margin call..jadi consistence dgn 2% risk.....kerana spike, slippage dan market choppy adalah penyakit yg serious kepada breakout dan trend follower system

Posted by BETRAS SWING SYSTEM at 11:48 PM 0 comments

DONT EVER PREDICT THE MARKET - RICHARD DENNIS TURTLE'S

Thursday, December 8, 2011Lagendary trader - Richard Dennis adviced to his turtles:-

A turtle never tries to predict market direction but instead looks for indications that a market is in particular state, This is an important concept. Good traders dont try to predict what the market will do; instead they look at the indications of what the market doing

"Penyu" tidak pernah cuba untuk meramal arah pasaran tetapi melihatan tanda-tanda (petunjuk) pasaran dalam keadaan tertentu, ini adalah satu konsep yang penting.Trader yg bagus tidak cuba untuk meramalkan arah pasaran , sebaliknya mereka melihat tanda-tanda (petunjuK) pasaran dlm keadaan tertentu ketika itu.

org bukan islam pun tidak percaya pada ramalan (fortune teller), mari kita kaji diri kita

http://

Posted by BETRAS SWING SYSTEM at 4:49 PM 0 comments

SAY GOOD BYE TO MARGIN CALL WITH THIS RISK & MONEY MANAGEMENT SOFTWARE

Wednesday, November 30, 2011Posted by BETRAS SWING SYSTEM at 4:09 PM 0 comments

THE POWER OF RISK & MONEY MANAGEMENT -winning string (click at photo for bigger view)

Wednesday, November 23, 2011Posted by BETRAS SWING SYSTEM at 3:44 PM 0 comments

RISK & MONEY MANAGEMENT SOFTWARE CONTROL DRAW DOWN EVEN AT STRING LOSSES (Click at photo for bigger view)

Tuesday, November 22, 2011Just imagine with basic money management with 15% risk..with 10 consecutive losses....not even 10 losses in the row..you account have long time wipe out!!!.

Next article....How this risk & Money management can protect your profit from string losses and grow your account exponentially.

Happy trading. wasalam

Posted by BETRAS SWING SYSTEM at 3:41 PM 0 comments

THE POWER OF PROPER RISK & MONEY MANAGEMENT (Single click at the photo for bigger view). Your Pips is negative but you equity is still gain

Sunday, November 20, 2011As salam, lg satu contoh. The power of proper risk & money managament, 12losses, 8 win (-200pips) tetapi equity still gain USD384.00 . just imagine. jika winning rate system anda melebihi 50% dgn risk reward 1 to 1. wasalam,,

Posted by BETRAS SWING SYSTEM at 7:38 AM 0 comments

THE POWER OF PROPER RISK & MONEY MANAGEMENT (Single click at the photo for bigger view)

Saturday, November 19, 2011Ramai dikalangan kita yg tidak kisah langsung Dgn risk & money management. dibawah ini sy akan tunjukkan simulation Software walaupun winning rate 50%, risk reward ratio 1:1, kene stoploss 10 dan win 10 (SL 50pips & TP 50Pips) tapi still gain dlm profit. mcmana tu?

Posted by BETRAS SWING SYSTEM at 8:26 PM 0 comments

MAKE MONEY WITH TRADING AND AFFILIATES COMISSION AND SPONSERING WITH HOTFOREX

Wednesday, November 16, 2011CLICK THE LINK BELOW - REGISTER AS AN AFFILIATE'S AT HOTFOREX AND OPEN A TRADING ACCOUNT USE YOUR AFFILIATE'S LINK

http://www.hotforex.com/?refid=9115

Posted by BETRAS SWING SYSTEM at 4:03 PM 0 comments

MAKE MONEY WITH TRADING AND AFFILIATES COMISSION AND SPONSERING

As salam, sebelum anda membuka ekaun di Hotforex adalah lebih baik anda menjadi affilliates dulu sebelum anda bukak ekaun. selepas itu bukak ekaun dgn link affilliates anda supaya komisen anda tidak ditelan buta buta oleh broker, at least sikit sikit pun duit juga. Kita ultilise peluang dan kemudahan semaksimum yg mungkin dan gunakan peluang ini...ianya tidak salah. anda pun boleh menaja affilliate lain juga. mari register sebagai affilliate seperti link dibawah.

http://www.hotforex.com/?refid

Wasalam

Posted by BETRAS SWING SYSTEM at 3:56 PM 0 comments

NEW TRADING PLAN (remove EURGBP replace with USDCHF) Tf 30min

Trade EURUSD 60min, GBPJPY 30min, EURAUD 30min, USDCHF 30min, USDJPY 30min and NZDUSD 60min. for EURGBP....$/Pip/Lot = 16 and Pips/Unit = 10,000 "please update your trade management software". BUY STOP: Do key level adjustment (00' and 05' level and adding the spread with 1 tp 2 pips extra). SELL STOP no need KEY Level adjustment, just adjust to 00' and 05" level only ..

Trading Plan.

1. Take the set up that is still valid at (6.00am SGT in the morning or 5.00pm EST daylight in the evening)

2. Take the set up that still not trigger or less then 20% toward target 1 and the entry need to be adjusted at below swing or upper swing at the 20% toward target

3. do key level adjustment for buy stop only and adjust to "00" and "05" level only for sell stop.

4. Take target 1 only.

5. account more the USD1000 dont trade with 5% risk, you will be physiologically effected.

6. When your trade time zone is end, shut down your computer and walk away, check the progress once or twice only, if the trade 90% toward your target move stoploss to profit zone or you can close the trade.

7. Please up date your risk and money management software under the currencies slide and add up the additional pairs and the value

8. Skipped any obvious spike set up with a large range

Posted by BETRAS SWING SYSTEM at 3:33 PM 0 comments

Characteristics of Highly Successful Traders

Saturday, November 12, 2011For those serious about trading for a living, the following list of traits uncovers traits found in every highly successful trader. Realize that 1% of the people who play this game take 99% of the profits. That means 99% of people who call themselves “traders” are forking over all their money to the 1% of serious and consistently profitable traders.

The list of typical success traits such as discipline, focus, passion, commitment, determination, and confidence can be found in almost every trading book and, if applied, right can act as a framework for achieving success in all aspects of life.

These 12 traits of highly successful traders are a result of in depth comparison of hundreds of the world's top traders, many of which are talked about in the books Market Wizards and New Market Wizards by Jack D. Schwager.

If you want to make it in this game then strive to acquire these traits of highly successful traders…

Discipline: It’s all or nothing

So you think you’re disciplined? If you’re not disciplined 100% of the time, you cannot call yourself disciplined. This is something you must exercise each and every time you place a trade. If you break your rules just once, you cannot call yourself disciplined.

As an active participant in the markets there WILL be times when you feel that it’d be okay to act on your intuition, not following your plan that you so diligently laid out, because “this time is different” and “I will only do it once” well, unfortunately it doesn’t work that way. The notion of “Cut me a break and I’ll never do it again” causes traders to blow up their accounts. You MUST live to trade another day.

The market pays you to be disciplined.

Losing the right way

Trading is a game of statistics, and as such nothing is 100%, you will have losses, every trader does, what separates the highly successful traders from the perennial losing trader is how they lose. The following 3 rules are indisputable to the success as a trader.

1. Always use stops

A trader who doesn’t use stops is at the same risk as one attempting to cross the Atlantic Ocean…by row boat. You may have a target in mind, but once the storm comes, you’re almost sure to drown.

2. Never turn a winner into a loser

Once your trade is going in your favor and crosses a predetermined target you must get your stop to break even. This allows you to limit the number of full stop outs, putting you in control of your risk.

3. Never take a big loss

If you’ve followed rules one and two then rule #3 will result by default. The only type of loss that can hurt you is a big loss and can wipe out days, weeks, or even months of profits. As a starting point, never risk more than 1.5% of trading capital per trade.

Follow these three rules to manage your losses and the profits will come. Don’t follow them and it will be like swimming with an open wound in shark infested waters; you will be torn to pieces.

Commit to learning

The markets are constantly changing and adapting, you must do the same. Before you begin trading a new market you must fully understand how it works. Some of the world’s greatest traders can be found trading the futures markets. These traders have tens of years or experience and have traded through the various cycles of the market, what makes you think you can beat them?

Make the promise to yourself to never stop learning and you find yourself constantly exposed to new opportunities as the market evolves. However, it all begins with the fundamentals, so know your market.

Discover your inner personality

No better place will you uncover your true self than in trading. The markets have a way of exposing your flaws and dragging you out of your comfort zone. It is imperative that you match your trading approach to your personality or else you will be stuck in a battle which you cannot win.

Highly successful traders know themselves better than any other industry professionals. In trading, your emotions are tested to their breaking point, your reactions to winning and losing are exposed, and your will power to persevere is challenged. Just like in golf, there is no hiding behind anyone else, you are held accountable for your actions as a trader.

Be honest with yourself; build your trading plan to fit your personality.

Think for yourself

This is one of the hardest traits to acquire, but all highly successful traders think for themselves. Don’t let others influence you or change your mind about a position. Turn off the talking heads on CNBC, and come up with your own ideas.

The fruits of your success will be in direct ratio to the honesty and sincerity of your effort in keeping your own records, doing your own thinking, and reaching your own conclusions. The average man doesn't wish to be told that it is a bull or a bear market. What he desires is to be told specifically which particular stock to buy or sell. He wants to get something for nothing. He does not wish to work. He doesn't even wish to have to think.”

- Jesse Livermore

No one can predict for certainty where the market is headed, do your own thinking.

Clarity in your plan

It is true that most plans fail, but you will be far more likely to succeed if you have a trading plan, than if you don’t. Ask yourself the following questions and refine them until you have a crystal clear framework for moving forward as a trader…

What is my motivation to become a trader?

How will my life suffer if I don’t give 110% in becoming a trader starting right now?

What is my current net worth?

How much money do I need to support myself, my family, and current lifestyle?

Do I have a habit of making impulse purchases?

A self analysis of yourself should be answered honestly and clearly to act as a framework for building a career as a trader or any other endeavor. The book, Think and Grow Rich by Napoleon Hill is one to be read over and over again, as the principals directly apply to trading and to leading a successful and fulfilling life.

Be Decisive

Hesitation is the most dangerous quality of an inexperienced trader. Hesitation can come from…

Not having conviction in your trading plan

Trading a size to large for your account and comfort zone

Most commonly, lack of experience

The ability to react decisively comes from one thing, experience. The more screen time that a trader has in actively trading the markets and analyzing charts the more conviction they will have when it comes time to pull the trigger.

When you hesitate you are letting the market build up steam, without a defined entry, defined stop, and defined profit target, you will find yourself in the lost world of chasing trade after trade, inherently watching great setups pass you by, only to finally enter as the professionals (the highly successful 1%) are taking profits.

In the book Outliers, Malcolm Gladwell talks about the power of 10,000 to mastery. You can use the time when the markets are closed or not highly participated on to review trade setups and fine tune your edge, inching you closer to those 10,000 hours.

Commit to doing whatever it takes

No one said trading is easy. The most rewarding things in life come from the result of hard work. This trait in particular applies to all aspects success, but as it relates to highly successful traders most started with little or nothing in terms of trading capital, do not have an Ivy League education, and built their success in the face of people telling them they it couldn’t be done.

To become a highly successful trader you must have a level of passion that drives you to do whatever it takes to reach your goal. Without this passion the journey is useless.

Build confidence over time

Find something positive about every situation, empower positive self talk

Congratulate yourself for following your rules, regardless if the trade is a winner or loser

Stick with one methodology; don’t jump ship looking for a new system every time you have a losing trade

Trade to trade well and the money will follow

Commit to doing whatever it takes to achieve success and the opportunities will present themselves.

Patience Pays

Be quick to take losses, slow to take profits. Highly successful traders remain patient throughout their trade. When a trade is going against us, we have stops to cut the loss, but when a trade is going in your favor it is also important to have profit targets.

Predetermining your exit point is a two way street, you must know your stop loss AND your profit target before entering the trade. Predetermining these levels will eliminate impulse trades, trades that are placed based off feel as the market is coming into your price. Impulse trades WILL cause you to fail.

One strategy to capitalize on winning trades is to scale out of your winners. A loss should always be exited in full at your predetermined stop point, however when a trade is going in your favor, having multiple targets allows for the trade continue working in your favor.

Exiting half the position at your first target, half of your remaining position at a second target, and the last portion (1/4 of the original) at a third and final target can be an effective way to capitalize on your winning trades. Trail stops can also be used for extracting the most out of a winning trade.

Remain Humble

There is no better place to become humbled than the market. In living your life with a level of humility and respect, you will be rewarded. The emotional drive of fear and greed will be the life and death to most traders. The highly successful traders understand that the market is always right no matter what they may think.

Karma will come back around, so give before you receive.

Honestly, keep accurate and detailed records

The importance of a sound trade reporting system is often one area overlooked. Once your trade data has been logged you are then able to go back and analyze commonalities among different setups. Recording market data is another good way to go back and spot common occurrences that you can then develop strategies to profit from.

There are a few good tools out there to help with analyzing your trade data, including Microsoft Excel. Some of the things you might want to record and analyze are…

Profit/Loss of each trade

Time you placed the trade

How you felt as you entered, during, and exiting the trade

Total number of trades taken

Average Risk/Reward per trade

Winning Percentage

Having too much information is never a problem, so when in doubt, jot it down. Get a trading journal and record your thoughts, emotions, market information, and experiences as go, these are great tools to be able to look back on and extract profitable information from in the future.

Balance: Why do this?

The bottom line in being a trader is to make money, of course. However, ask yourself is what you’re giving up to achieve your goals worth it? Many traders get enveloped in a downward spiral of losing trades and in worst case scenarios, watch their life savings, marriage, and health suffer. Balance is so important if you want to reach your goals with any chance of savoring some level of happiness and fulfillment.

The stress of managing your own business can be immense. The emotional and monetary pressures to provide for yourself and your family can begin to eat away at the fundamental things that we enjoy in life. Simple things to help you live a balanced life are...

Put your family first, above all else

Eat healthy meals

Exercise at least 60-minutes a day

Get adequate sleep

Taking frequent walks outdoors

Organize your tasks for the day into specific action steps

Dream big, but set realistic and attainable goals attached to a definitive date

We trade for the freedom to run our lives how we choose, not having to answer to a boss or punch in on the clock. Trade to live, don’t live to trade.

If you’re serious about trading for a living, working to incorporate these traits is a step closer towards your goal. Beginning from a holistic approach and outlining why you want to become a trader in the first place will help drive you through the tough times as they are inevitable.

Just like Karma and the law of reciprocity, what comes around goes around. There are no shortcuts to becoming a highly successful trader. Take control of your future today and make the commitment to do whatever it takes to succeed.

Posted by BETRAS SWING SYSTEM at 9:17 PM 0 comments

THE IMPORTANT OF PROPER RISK & MONEY MANAGEMENT IN TRADING

Sunday, November 6, 2011ATTENTION!!!!!!!!!

ATTENTION DONT TRADE THIS SETUP WITHOUT TRADE MANAGEMENT SOFTWARE. PROPER MANAGE YOUR TRADE...EVEN THOUGH SOMETIME YOUR PIPS IS NEGATIVE BUT IN TERM OF MONEY YOUR ARE IN THE BLACK (GAIN)

Example, U use 2% risk in every trade,

1st trade with SL 100pips and hit the stoploss - 100pips and loss 2% from your margin

2nd, 3rd and 4th trade with SL 20 pips, 30pips and 25pips all wins. Let say trade just use TP1, so you get +20pips, +30pips and +25pips ..overall +75pips, overall gain from your margin is 2%, 2% and 2% overall +6%

Let compare interm of pips you are under water -100pips + 70pips = -30pips (negative), but interm of gain in money you are in black -2% + 2%+2%+2%= + 4% (positive)

so you must understand dealing with swing trade must use with money management software because the stoploss and take profit is varies base on market volatility.

It is so different if you use fixed stoploss dan fixed risk. u need a positive in pips to make sure positive in gain interm of money

Happy trading

Posted by BETRAS SWING SYSTEM at 7:50 PM 0 comments

RISK MANAGEMENT (MANUAL or AUTO CALCULATE). which one you prefer?

Saturday, October 1, 2011let say you start with $1000.00 account and use 3% risk for every trade:-

1. $1000 x 3% = $30.00 risk fro every trade.

2. you trade EURUSD with predetermine stoploss 60pips.

3. If you use mini account $1 x 60pips = $60.00 so you cannot trade with mini.

4. If you use micro $0.10 x 60pips = $6.00.

5. so $30/$6 = 5micro lot.

Off course you cannot use full size account because $10 x 60pips = $600.00

must remember every pair have different pip cost.

With BETRAS SWING WE CALCULATE RISK AND MONEY MANAGEMENT USING CUSTOMISE SOFTWARE

Use BETRAS risk & money management software make your trading easier . watch this video:

http://www.youtube.com/wat

Posted by BETRAS SWING SYSTEM at 4:15 PM 0 comments

NOTIFICATION FOR BETRAS SWING USER (Very impportant)

Saturday, September 17, 2011Some of you neglecting the risk & money management and not calculating the lot sizing. keep on changing pairs and TF more often then you changing your underwear... be careful. you neglecting the risk and Money management...disaster. be careful with you set up entry, stop loss and target, do it correctly. when others people equity high this month, WHY some of you EQUITY drowdown, we trade the same system and same set up....please follow my update set up if any set up.

wasalam.

http://betrastrade.blogspot.com

Posted by BETRAS SWING SYSTEM at 6:13 PM 0 comments

BETRAS SCALP FIBPIVOT (Free for BETRAS SWING USER ONLY)

Thursday, September 8, 2011Posted by BETRAS SWING SYSTEM at 6:07 PM 0 comments

TRADING NIGHMARE FOR TRADERS

Saturday, September 3, 2011Posted by BETRAS SWING SYSTEM at 5:47 PM 0 comments

NEWS TRADE but RISK STIL UNDER CONTROL, DONT NEED TO WORRY.......BETRAS SYSTEM (Bahasa version )

Thursday, August 11, 2011Kebaikan trade news, winning rate tinggi, profit cepat dan byk

keburukan trade news, cepat loss, slippage. off quote, no connection dan broker ada byk hidden rules dan clauses yg akan menghalang kelancaran NEWS trading. SELAMAT MENCUBA....saya personally tidak mengemari news trading

Posted by BETRAS SWING SYSTEM at 4:08 AM 0 comments

SUMMER IS HERE, SCALE DOWN YOUR TRADING OR OFF TRADE

Thursday, August 4, 2011As Salam & good day

I will say this. With the US Markets and Dollar in Turmoil with the debt issues and the EURO on edge, things can happen and fast. Even swing trading, you can get spiked in and out. Might be a good time to take the month of August off, like most of Europe. Good trading to you all and i keep update the set up as usual

wasalam

Posted by BETRAS SWING SYSTEM at 5:29 PM 0 comments

SUMMER FEVER

Sunday, July 24, 2011As we expected, SUMMER MARKET is sluggish, lack of volume and volatility and a lot of unexpected market spike and reverse...but it part of trading and business. As long as your are discipline and reducing your risk during this season..YOU ARE at THE RIGHT TRACK

Note:

RICH PEOPLE PLAY THE MONEY GAME TO WIN

POOR PEOPLE PLAY THE MONEY GAME TO NOT LOSE

RICH trader...overall intention is to win. win more then loss = gain

POOR TRADER, searching for Holy grail system that not to lose...afraid of lossing trade, afraid of call margin, play with small amount....take this lesson, and train your subconscious MIND to be a successful forex trader/intrepreneur/invest

Posted by BETRAS SWING SYSTEM at 6:01 PM 0 comments

BETRAS REDUSING RISK or TIGHTEN STOPLOSS PROCEDURE

Tuesday, June 28, 2011Happy trading

Betras couch : ROMZZ

Posted by BETRAS SWING SYSTEM at 4:33 AM 0 comments

Salam & Good day, BACKTESTING HAS BECOME EASIER THEN EVER WITH BETRAS SWING SYSTEM

Tuesday, June 14, 2011saying, "Go, go, go" - Shoot first; ask questions

later. But when you're dealing with your own

hard-earned money, you better think twice or

you're going to end up BROKE as a joke.

back testing the system is very important to build your confident

to you trading system. without proper back testing dont trade any

system that you purchase

http://betrastrade.blogspot.com/

Posted by BETRAS SWING SYSTEM at 3:50 PM 0 comments

why Key level adjustment important 00 and 05 level

Sunday, June 12, 2011Posted by BETRAS SWING SYSTEM at 4:22 PM 1 comments

Triggering price and spread issues

Tuesday, June 7, 20111. EURUSD/EURGBP/USDJPY/NZDUS

2. GBPJPY/EURAUD + 4 pips from entry for eurica account and (no spread but commission) + 7 pips from entry for standard account (commission are in spread form)

Posted by BETRAS SWING SYSTEM at 4:03 PM 0 comments

NOTIFICATION TO ALL BETRAS SWING USER - USELESS, UNNECESSARY AND REPEATING MISTAKE

Wednesday, May 4, 20111. Please apply the risk and money management - its vital.

2. Please control your risk - my system is not a holy grail...any others method too.

3. Please stick to certain pairs only and trade it consistently. Dont jumping from one pair to another pair

4. Please stick to specify time frame. dont keep on changing the time frame for the pairs.

5. Please stick to your trading session religiously (Asian, eur or US open)

6. Be minimalist Trader..that means less trade give better performance, many of us misunderstood many trade that means more money..but actually vise versa our are LOSING money

7. Just trade when the System is telling your when, what, where to enter the market...not anytime when your open your laptop and simple enter the market to make money..but end up losing money.

I think that all I want to say...because.... InsyAllah without following the rules you may sedekah all your hard earn money to the most rich organization in Forex industry (The Broker)....very quickly. It better to sedekah your money to all poor people.

Trade without Plan and must following the plan, risk control, tight money management is just like Digging your own grave for your hard Earn money

ROMZZ

BETRAS SWING DEVELOPER & TRADER

Posted by BETRAS SWING SYSTEM at 4:25 PM 0 comments

SWING TRADING VERSUS DAY TRADING

Tuesday, April 26, 2011Swing trading and day trading are both active trading practices which require different strategies, techniques, and money management. Many times the tools they use are different. However, BETRAS offers indicators that can do both or just focus on swing trading.

We all know that day trading can be a full-time job and that you hold positions for very short times. The main advantage to this is that you don’t have to worry about holding positions overnight. Then, you are often flush with cash in the morning ready to jump when an opportunity presents itself. Although, your trading costs will be higher as you place more trades and you will make smaller profits on each trade compared to swing trading.

Now if you can deal with the anxiety of holding positions overnight and maybe waking up to a loss or the market moving against your position, then swing trading may be for you. This is how it works. You capture very large moves, potentially making huge profits on these moves. You only place a few trades a week and you don’t have to watch the market all the time. Every trade you enter has a stop and target already placed so you know ahead of time what your risk is. You don’t have to trade full-time and it really can take only 10 minutes a day.

So before you decide whether swing trading or day trading is right for you, answer the following questions.

1. Do you have the time to day trade?

2. If you’re holding a position over night or for days, will you have the ability to sleep and not worry about the trade?

3. Can you let the swing trades move to their targets and not close them early?

4. How much money do you have to start trading and are you looking to add an income stream or just grow your nest egg over time?

5. Finally, how much risk are you comfortable with?

Happy Trading to all BETRAS SWINGER

Posted by BETRAS SWING SYSTEM at 4:05 AM 0 comments

How Does the BETRAS SWING Deal With Choppy Forex Price Action?

Sunday, March 6, 2011

1.We acknowledge that there will be losing trades within a winning strategy.

2.We go on to acknowledge that you can not divorce the losses from the winners or you will NOT get the winners.

3.Inst...ead of trying to avoid the losing trades (which in our opinion is ‘holy grail’ stuff and does not exist) I designed the BETRAS SWING) to mitigate the losses. Mitigation is an important concept and the sooner you learn it, the sooner you will improve your trade results.

4.It is a combination of great setups that take advantage of edge of the chart price action, smart confirmations, smart RULES that include how to make minor key level adjustments, disciplined dynamic goal setting , tight and concise tradeplans that should be followed the same way every day, a dynamic stop strategy that cuts risk and seeks to get to a risk free position

5.With all that, we then accept the losses that we do get, trade through them, and let the magic of the system work itself out, which is why we keep getting all those attractive equity curves you’ve seen. The losses get you to the winners.

6.Remember, if a solid winning tradeplan (anything from 60% on up) is winning a majority of the time, the other smaller part of that equation are the losing trades. No one can control the market but we can control how we trade it and how much risk we expose ourselves to. We can then manage our risk as the trade progresses. That way, we get the most out of the winning trades and reduce our risk as much as possible on the losing trades while still trying to give the trade the room it needs to develop. It’s a fine line that is never perfect. Anyone who tells you otherwise is selling you a dream but not reality. Yet you’ll find the betras swing trading does an amazing job at it.

7.With all that being said, the betras swing tradingdoes have an uncanny way of consistenly delivering the goods if you develop your own ability to trade it with discipline and confidence. When a few losses come your way, you have to rely on the knowledge that the betras swing is fast to recovery and will give you explosive, profitable trades that launch your two steps forward. Two steps forward, one step back, two steps forward, one step back. That is a healthy and realistic process and the path to ever growing profits. ALL profitable equity curves ‘stair step’ their way, up, and to the right. Accept this and be at peace with it. That’s the business we’re in. This is where the process needs to begin.

The trade examples this month, exemplify ALL these elements, working together, producing the winning edge that the betras swing will give you IF you have all your package covered. To this day, the plan continues to work.

Posted by BETRAS SWING SYSTEM at 4:09 PM 0 comments

10 top ways new forex traders LOSE MONEY

Tuesday, February 8, 2011

2.Unreasonable Expectations

3.Absence of a Sound Trading Plan

4.Lack of Discipline

5.Failure to Include Stop-Loss and Take-Profit Instructions

6.Excessive Leverage

7.Holding Too Many Open Trades

8.Holding Losing Positions Too Long

9.Ignoring Rate Spread Fluctuations and

the Impact Spreads Have on Profitability

10.Thinking About the "Big Win" More Than

Effective Cash Management (AKA Greed)

Posted by BETRAS SWING SYSTEM at 5:22 PM 0 comments

Risk & Money Managemenr DEADLY important in trading

Tuesday, January 4, 2011It is the Money Management that helps the pros when the market is not prepared to do what we expect it do do. Professional Traders realize that the system does not achieve their goals, its the Combination of The System and Money Management that attains their goals.

Money Management Is One of the most important aspects of a traders system. There is a real dearth of information on the subject, many professional traders all point to it, but none explain it, till now.

Posted by BETRAS SWING SYSTEM at 3:32 PM 0 comments

BETRASTRADE METHOD 3.2 SWING SETUP 2012

BETRAS SWING 3.2 SYSTEM (90% MECHANICAL 10% ART)

SUMMARY JANUARY 2012 PERFORMANCE:

12 wins, 3 losses . winning rate 80%, risk reward 1:1. Gross % gain before broker commission depend on your risk , lets says if use 2% = 2% x 9wins = 18% and 5% x 9wins = 45%

SUMMARY FEBRUARY 2012 PERFORMANCE

10 wins, 5losses . winning rate 66%, risk reward 1:1. Gross % gain before broker commission depend on your risk , lets says if use 2% = 2% x 5wins = 10% and 5% x 5wins = 25%

Mar 2012 performance 11 wins vs 6 losses .69% winning rate. clean wins 5 wins, gain, 2% risk with risk reward 1:1; 5 x 2% = 10% gain. If use 5% risk, with risk reward 1:1; 5 wins x 5% = 25% gain from equity

SUMMARY APRIL PERFORMANCE

April 2012 performance 9 wins vs 11 losses .45% winning rate. clean losses 2 , 4% drawdown, 2% risk with risk reward 1:1;

SUMMARY MAY PERFORMANCE

May 2012 performance 7 wins vs 2 losses .77% winning rate. clean wins 5 , 5% x 2 = 10% gain , 2% risk with risk reward 1:1;

SUMMARY JUN PERFORMANCE

JUN 2012 performance 12 wins vs 1 losses .92% winning rate. clean wins 11 , 11% x 2 = 22% gain , 2% risk with risk reward 1:1;

Detail Jun 2012 Performance

6th Jun 2012

1. USDJPY win + 55pips (2% gain)

2. EURAUD win +65pips (2% gain)

3. GBPJPY + 58pips (2% gain)

4. EURUSD +52pips (2% gain)

5. USDCHF + 42pip (2% gain)

14th Jun 2012

1. EURUSD win + 95pips (2% gain)

2. USDCHF win + 76pips (2% gain)

18th Jun 2012

1. USDJPY stopped out (-2%)

20th Jun 2012

1. GBPJPY win + 83pips (2%)

21st Jun 2012

1. USDJPY win + 67pips (2% gain)

22nd Jun 2012

1. USDCHF win 68pips (2% gain)

2. EURUSD win 95pips (2% gain)

28th Jun 2012

1. GBPJPY win + 50pips (+2%)

JOINT ME AT FACEBOOK

http://www.facebook.com/betrastradefx.forexedition